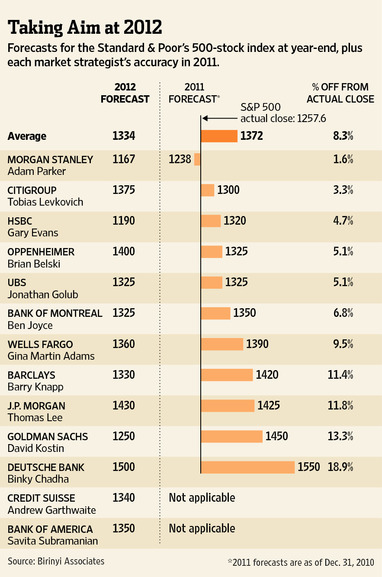

Goldman Sachs released their top picks recently. While they didn't do so hot in 2011, their 2010 trades were more fruitful. Here is what they think for 2012:

1. Short European High Yield credit (Buying protection on the iTraxx Crossover index), for a target of 950bp (opened at 770bp) and a potential return of 4.5%, stop at 680bp

2. Short 10-yr German Bunds for a target of 2.8% (open at 2.3%) and a potential return of +4.5%, stop 2.0%

3. Go long EUR/CHF for a target of 1.35 (opened at roughly 1.2260) and a potential return of 11% including carry, stop at 1.20

4. Long Canadian equities (S&P TSX) vs Japanese equities (Nikkei), FX unhedged for a target of 120 (opened at 100) and a potential return of 20%, stop at 90

5. Long a Global Rebalancing Basket (CNY, MYR versus GBP, USD) for a target of 107 (opened at 100) and a potential return of 7%, stop at 98

6. Long July 2012 ICE Brent Crude Oil futures for a target of $120/bbl (opened at $107/bbl) and a potential return of 12%, stop at $100/bbl

Source:

Zero Hedge