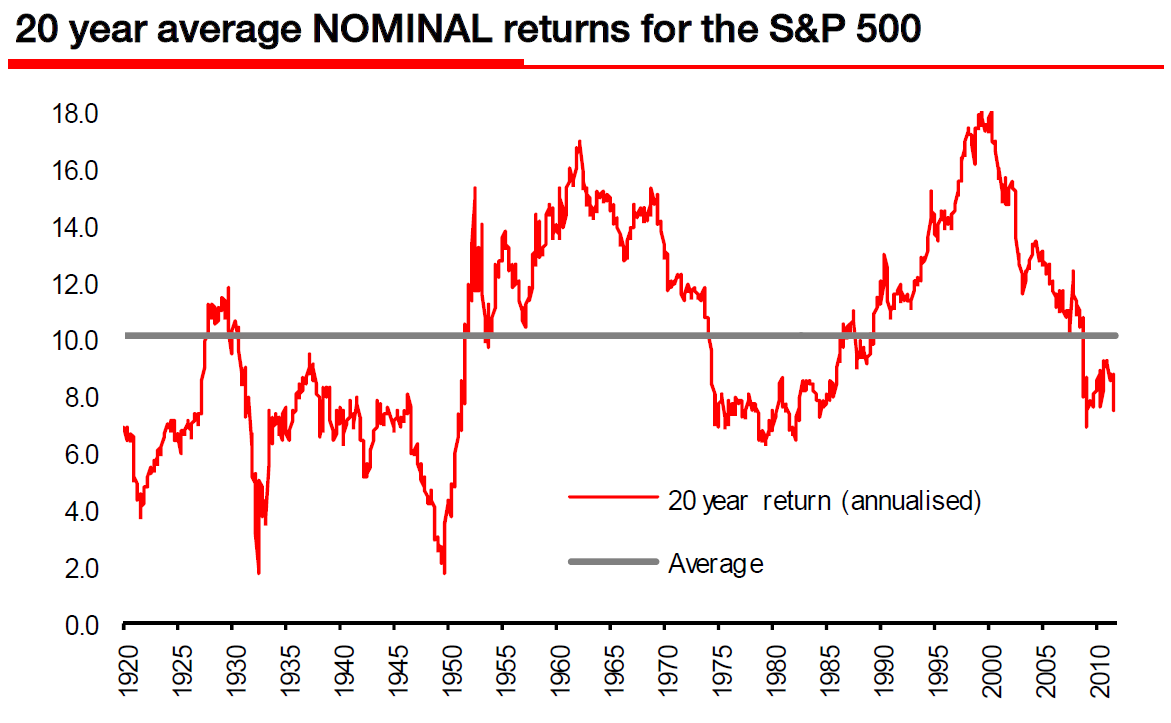

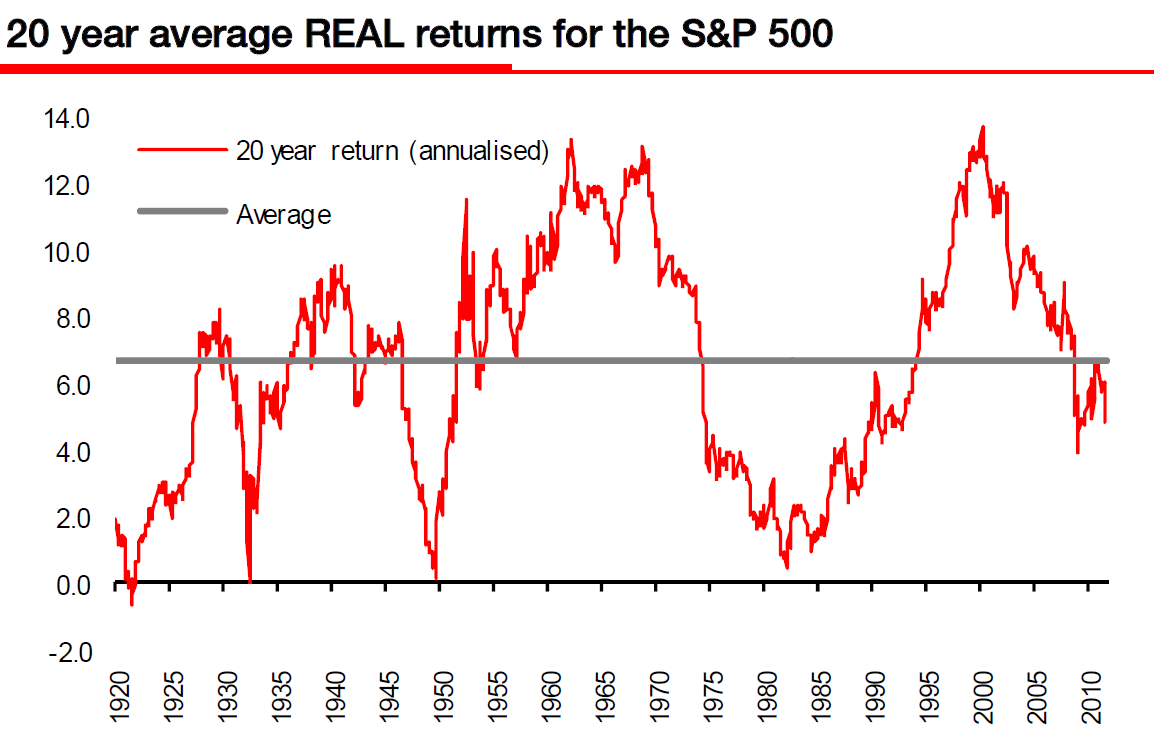

Referring to the graphs below, you can see that over the long term, the S&P 500 has returned an average NOMINAL return of about 10%. Adjusting for inflation, the bottom chart shows the average REAL return for the S&P 500 at about 7%. After ending the year precisely where it started in 2011, perhaps the S&P can revert to the mean in 2012.

Real return = Nominal return - Inflation

Source:

www.ritholtz.com