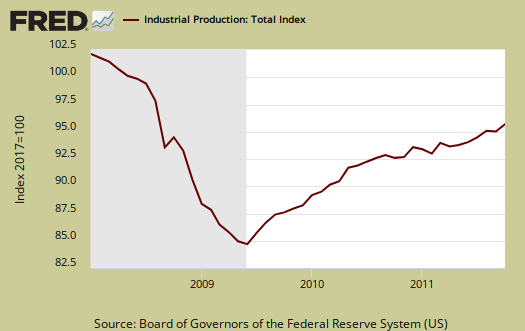

Specifically, this production data measures the total output of manufacturing, mining, electric and gas industries in the United States. At current levels, industrial production is still 5.3% below pre-recession levels.

The Federal Reserve published a nice breakdown of the industry groups that contribute to industrial production:

"Manufacturing output increased 0.5 percent in October and was 4.1 percent above its year-earlier level. In October, the factory operating rate moved up to 75.4 percent, a rate 11.0 percentage points above its trough in June 2009 but still 3.6 percentage points below its long-run average.

The output of durable goods increased 0.8 percent in October and has gained 7.8 percent in the past 12 months. Advances of at least 2 percent were reported in October for electrical equipment, appliances, and components; motor vehicles and parts; and aerospace and miscellaneous transportation equipment. In contrast, losses of 2 percent or more occurred for wood products and nonmetallic mineral products.

The index for nondurable manufacturing rose 0.2 percent in October. Among the major components of nondurables, the output of apparel and leather jumped 2.8 percent, and gains were also registered for food, beverage, and tobacco products; chemicals; and plastics and rubber products. Decreases were recorded for textile and product mills, paper, printing, and petroleum and coal products. The index for other manufacturing (non-NAICS), which consists of publishing and logging, declined 0.2 percent.

The output of mines climbed 2.3 percent in October, with gains in each of its major components, after having dipped 0.5 percent in September. Capacity utilization in mining moved up to 92.7 percent in October, a rate 5.3 percentage points above its long-run average. The output of utilities edged down 0.1 percent, and its operating rate declined to 77.5 percent, a rate 9.1 percentage points below its long-run average.

Capacity utilization rates in October at industries by stage of process were as follows: At the crude stage, utilization increased 1.5 percentage points to 89.9 percent, a rate 3.5 percentage points above its long-run average; at the primary and semifinished stages, utilization edged down 0.1 percentage point to 74.0 percent, a rate 7.3 percentage points below its long-run average; and at the finished stage, utilization rose 0.7 percentage point to 77.2 percent, a rate 0.1 percentage point below its long-run average."

Source: Federalreserve.gov