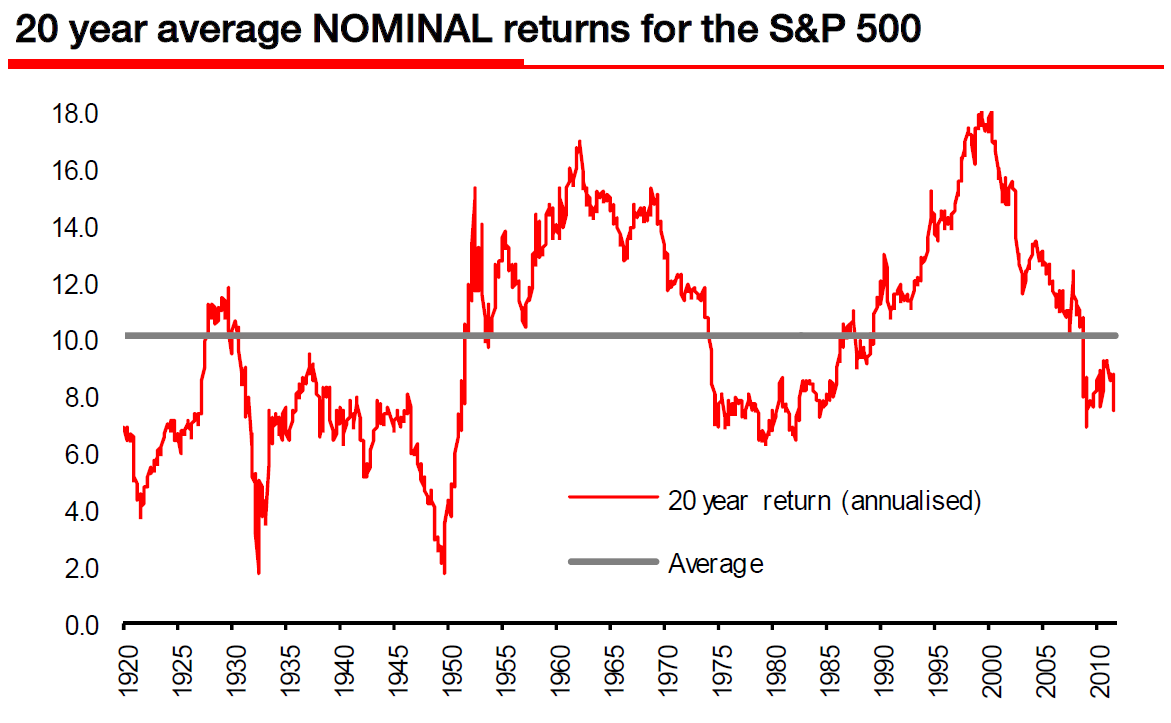

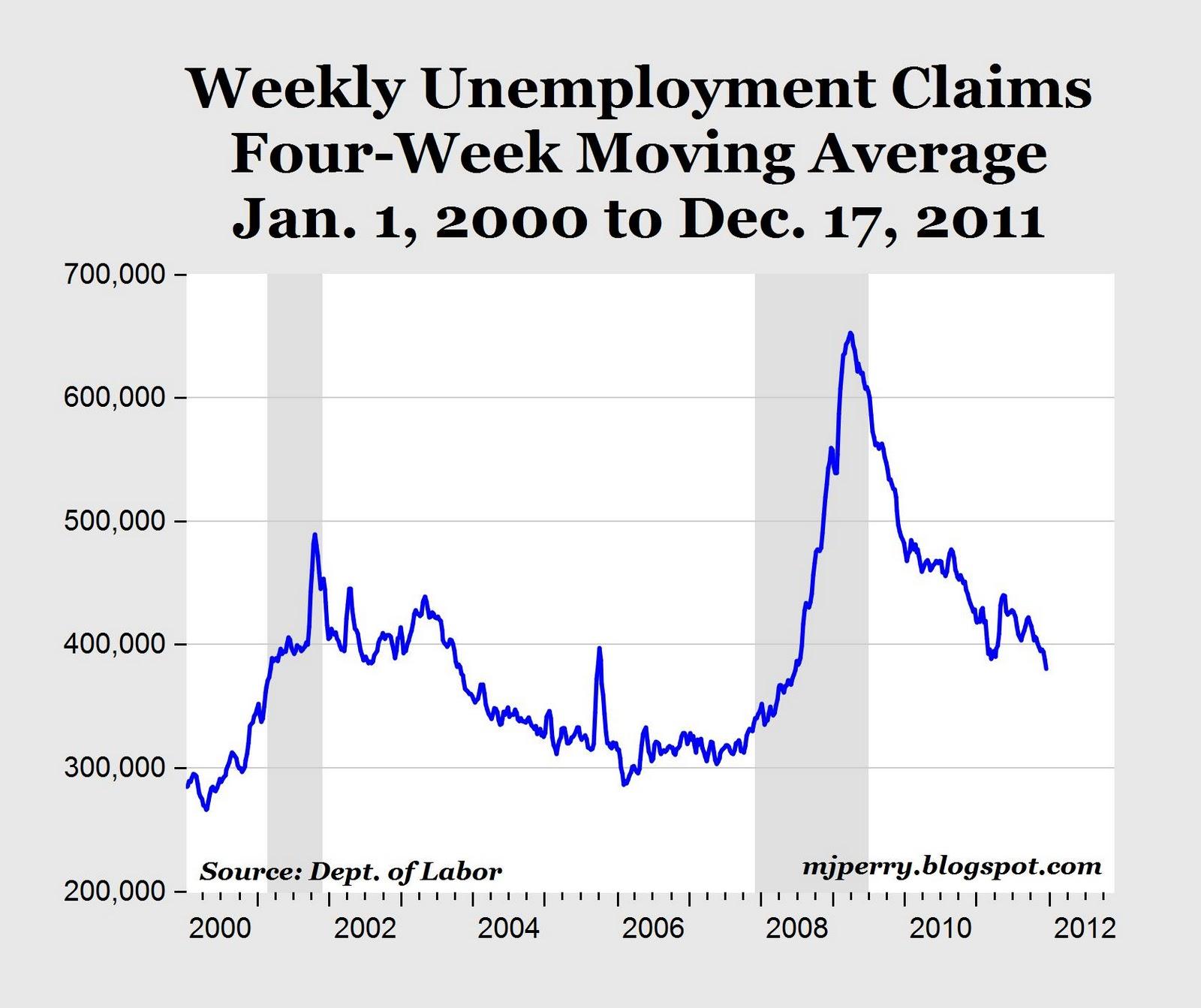

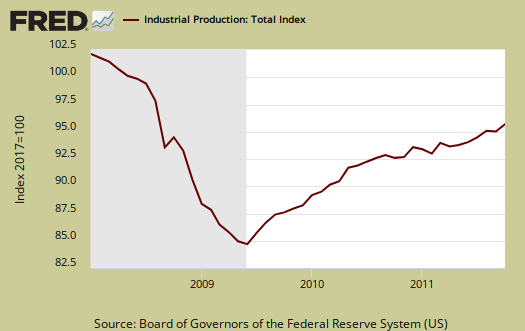

14 million Americans are unemployed and yet one sector can't hire new employees fast enough. Looking at the charts below, it is plain to see that manufacturing job vacancies in the United States aren't being filled to meet demand. In fact, the October 2011 unemployment rate for manufacturing was 7.7% compared to the overall unemployment rate of 9.0% (per the

Department of Labor).

Consider this, on average it takes companies about 7 weeks to fill a vacant job. Recently, hiring a new manufacturing employee has taken approximately 12 - 15 weeks.

This data supports the notion that there is structural unemployment in our economy, where American skills and American jobs are mismatched. High unemployment rates aside, think of the lost production / GDP / consumption our economy is missing out on.

Fixing structural unemployment will take time. Troops returning home will have solid military training, which may translate well into the manufacturing workplace, but that alone is not the solution. Americans will either have to outsource a segment of this supply chain or place a larger emphasis on trade skills in our educational system.

One thing is certain: manufacturing is fueling much of our economy's current growth. We need to support the strength of this sector.

|

| This graph illustrates how job openings in the manufacturing sector have outpaced total nonfarm job openings from the depths of the recession. |

Sources:

stlouisfed.org

cleveland.com